More House, Same Budget: How Lower Rates Change the Game

Posted by Judy Orr on

How Mortgage Rate Drops Boost Your Buying Power: What You Need to Know

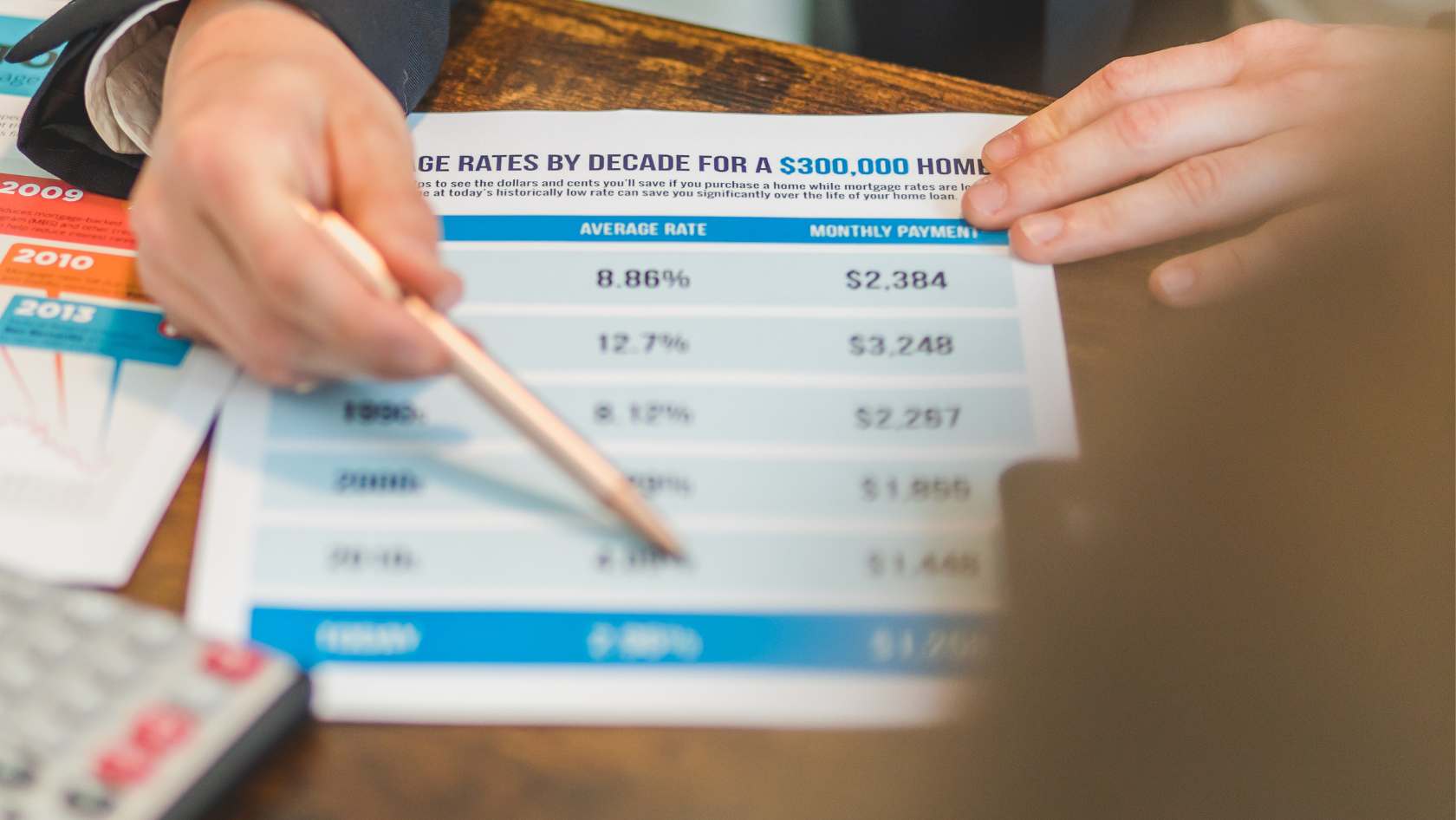

Remember the days when mortgage rates seemed stuck in the stratosphere? Those days might be behind us—at least for now. Mortgage rates have recently dropped to their lowest point in 11 months, creating a golden opportunity for homebuyers. This shift in the financial landscape isn't just a minor blip on the radar; it's a significant change that could put your dream home within reach.

Understanding the Real Impact of Falling Mortgage Rates

When mortgage rates fall, even by what seems like a small percentage, the effects change your finances in surprisingly powerful ways. Think of mortgage rates as the price tag for borrowing money. Just like you'd celebrate a sale at…

302 Views, 0 Comments