How Mortgage Rate Drops Boost Your Buying Power: What You Need to Know

Remember the days when mortgage rates seemed stuck in the stratosphere? Those days might be behind us—at least for now. Mortgage rates have recently dropped to their lowest point in 11 months, creating a golden opportunity for homebuyers. This shift in the financial landscape isn't just a minor blip on the radar; it's a significant change that could put your dream home within reach.

Understanding the Real Impact of Falling Mortgage Rates

When mortgage rates fall, even by what seems like a small percentage, the effects change your finances in surprisingly powerful ways. Think of mortgage rates as the price tag for borrowing money. Just like you'd celebrate a sale at your favorite store, lower mortgage rates mean you're essentially getting a discount on your home purchase—not on the price tag, but on the cost of financing that purchase over time.

The beauty of rate decreases lies in their dual benefit: you can either reduce your monthly payment for the same property or stretch your budget to afford a more expensive home while keeping your monthly payment unchanged. This flexibility gives you options that simply weren't available when rates were higher.

Let's break down what happens when rates fall:

First, your monthly mortgage payment decreases. This isn't just pocket change—we're talking about potentially hundreds of dollars every month over the life of your loan. That's money that stays in your pocket rather than going to interest payments.

Second, your total interest paid over the life of the loan drops substantially. On a 30-year mortgage, even a 0.5% rate reduction can translate to tens of thousands of dollars saved over the full term of the loan.

Third, and perhaps most exciting for many buyers, your purchasing power increases. You can qualify for a larger loan amount with the same income, opening doors to neighborhoods or home features that might have been just out of reach before.

The Numbers Don't Lie: How Much More Home Can You Actually Afford?

Let's put some real numbers behind these concepts. Imagine you're a homebuyer with a comfortable monthly housing budget of $3,000. This budget needs to cover your principal and interest payments (we'll set aside property taxes and insurance for this example to focus on the pure mortgage impact).

Back in June, when mortgage rates were hovering around 6.9%, your $3,000 monthly budget would have qualified you for a home priced at approximately $446,000, assuming you had the standard 20% down payment on a 30-year fixed-rate mortgage.

Fast forward to just a few weeks ago, when rates had dipped to around 6.5%. With that same $3,000 budget, you could suddenly afford a home worth $460,500. That's an additional $14,500 in purchasing power—without changing anything about your monthly budget.

And now? With rates recently hitting a new low of 6.27%, that same buyer can afford a home worth approximately $468,000. That's an additional $7,500 in purchasing power in just the past week alone, and a total increase of $22,000 in just three months.

What does $22,000 in additional purchasing power actually mean in today's housing market? It could mean:

- A larger primary bedroom or an additional bathroom

- A finished basement that adds valuable living space

- A more desirable school district

- A larger lot size

- Higher-quality finishes or updated systems

- A home that needs less immediate renovation

In competitive markets like Scottsdale, that additional purchasing power might be the difference between winning and losing a bidding war on your dream home.

Monthly Savings That Add Up to Major Financial Impact

Another way to look at the impact of falling rates is to consider the monthly savings on a specific home price. The median U.S. home currently costs about $444,000. If you purchased this median-priced home in June when rates were at 6.9%, your monthly principal and interest payment would have been approximately $2,624.

Today, with rates at 6.27%, that same home would come with a monthly payment of about $2,481. That's a savings of roughly $150 every single month. While $150 might not sound life-changing, multiply that by the 360 payments in a 30-year mortgage, and you're looking at a lifetime savings of $54,000. That's certainly nothing to sneeze at!

Let's look at what these numbers mean specifically for Scottsdale, where the housing market tends to run hotter than the national average. The median home price in Scottsdale is currently sitting at approximately $795,000. Assuming a 20% down payment:

- At 6.5%, your monthly principal and interest payment would be $4,020

- At the current rate of 6.29%, that payment drops to $3,940

- Monthly savings: $80

- Annual savings: $960

- Lifetime savings (30-year loan): $28,800

That might not sound like much, but you can see how it adds up. If you set $80 aside each month, you could build up almost $1,000 within a year. These savings represent real opportunities to improve your financial situation. That extra $80 per month in Scottsdale (or $150 nationally) could be directed toward:

1. Building a more robust emergency fund, providing greater financial security for your family

2. Accelerating payments on high-interest debt like credit cards or personal loans

3. Increasing your retirement contributions, potentially adding tens of thousands to your nest egg over time

4. Funding a 529 plan for children's education expenses

5. Creating a home maintenance fund to protect your investment

6. Investing in home improvements that increase your property value

7. Taking that vacation you've been postponing

8. Starting a side business or pursuing additional education

The beauty of these savings is that they continue month after month, year after year, without requiring any additional effort on your part once you've secured that lower rate.

Why Are Mortgage Rates Falling Now?

Understanding why rates are falling can help you make more informed decisions about your home buying timeline. Mortgage rates don't exist in a vacuum—they respond to broader economic conditions and Federal Reserve policies.

Recently, several factors have contributed to the declining rates:

- Economic data suggesting inflation is cooling, reducing pressure on the Federal Reserve to maintain higher interest rates

- Shifts in investor sentiment about the future direction of the economy

- Lower yields on 10-year Treasury bonds, which mortgage rates typically track

- Changing expectations about future Federal Reserve rate decisions

It's important to note that mortgage rates are notoriously difficult to predict with precision. While the current trend is downward, markets can change direction quickly in response to new economic data or global events.

Different Types of Mortgages and How Rate Drops Affect Them

Not all mortgages respond the same way to falling interest rates. Understanding how different loan types behave can help you choose the right financing for your situation:

30-Year Fixed-Rate Mortgages: These are seeing the full benefit of the rate drops described above. They offer payment stability over the entire loan term and are most homebuyers' preferred option.

15-Year Fixed-Rate Mortgages: These typically carry lower interest rates than 30-year loans to begin with. As market rates fall, 15-year mortgages also become more affordable, allowing buyers to pay off their homes in half the time while saving significantly on total interest.

Adjustable-Rate Mortgages (ARMs): These loans typically start with lower rates than fixed-rate mortgages but adjust periodically based on market conditions. In a falling rate environment, ARMs may not seem as attractive compared to locking in a fixed rate, unless you're planning to sell or refinance before the initial fixed period ends.

FHA and VA Loans: Government-backed loans also benefit from falling rates, often making homeownership more accessible to first-time buyers and veterans during periods of declining interest rates.

Timing Your Move: Is Now the Right Time?

With rates at their lowest point in nearly a year, many potential buyers are wondering if now is the time to make their move. While no one can predict the future with certainty, there are several factors to consider:

1. Housing inventory remains tight in many markets, including Scottsdale. Although it might seem like Scottsdale (or your area) has higher inventory, the best looking homes in their price range still go quickly, and many with multiple offers. Lower rates typically bring more buyers into the market, potentially increasing competition for available homes.

2. Seasonal factors are at play. Fall and winter traditionally see less buyer activity, which might offset some of the increased demand from lower rates and create opportunities for determined buyers.

3. Your personal timeline matters most. The best time to buy is when you're financially prepared and ready for homeownership, regardless of market conditions.

4. Rates could go lower—or they could reverse course. Trying to time the absolute bottom of the market is notoriously difficult and often counterproductive.

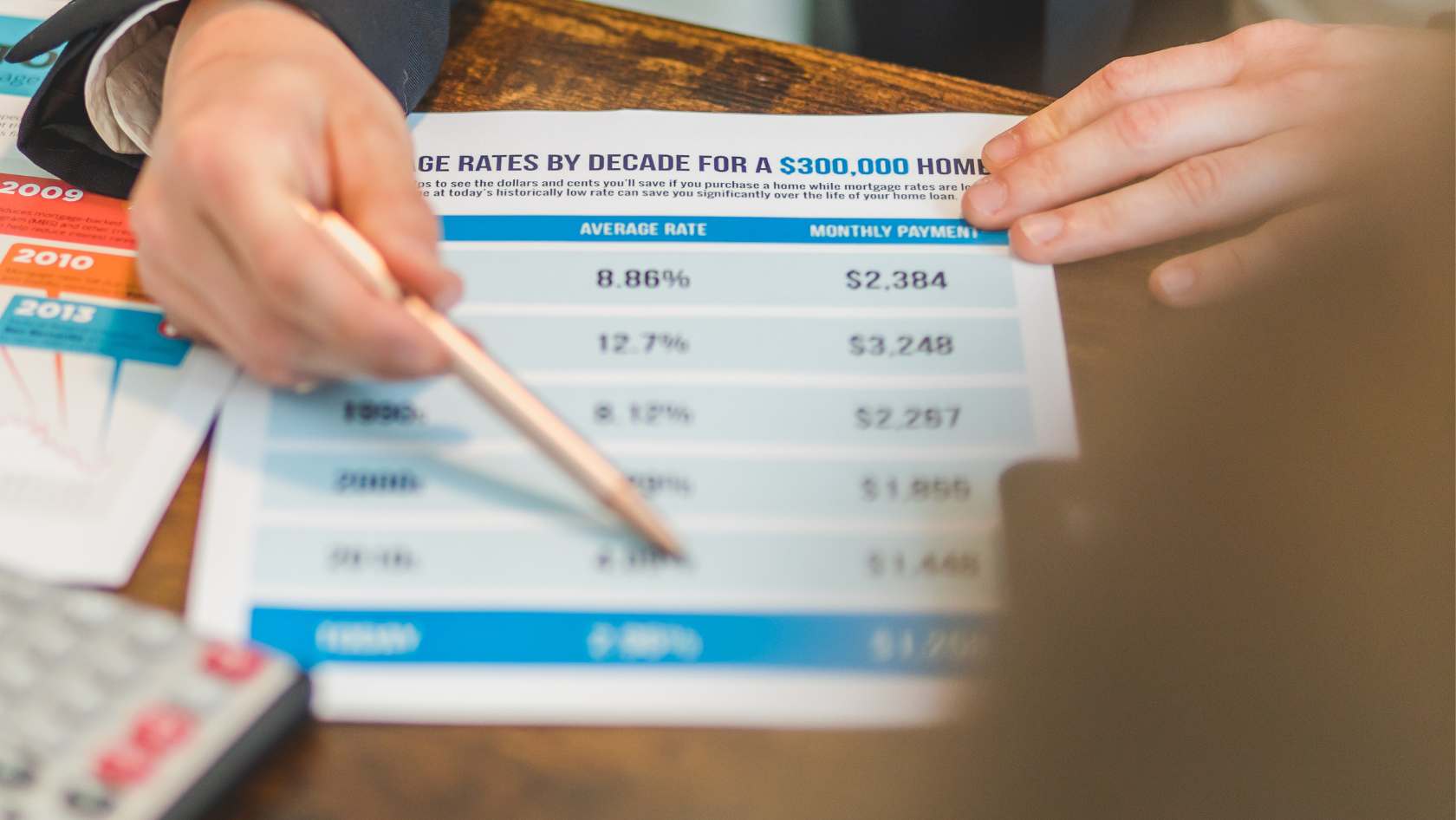

Remember that even today's "lower" rates of around 6.3% are still higher than the sub-3% rates seen during 2020-2021. However, they're also significantly lower than the historical average over the past several decades, which hovers closer to 7-8%.

Practical Steps to Take Advantage of Lower Rates

If you're considering jumping into the market to take advantage of these lower rates, here are some practical next steps:

1. Get pre-approved, not just pre-qualified. A pre-approval involves a more thorough review of your finances and gives you a clearer picture of what you can afford.

2. Calculate your true budget, including not just mortgage payments but also property taxes, insurance, maintenance, and potential HOA fees.

3. Work with a knowledgeable local real estate agent who understands the Scottsdale real estate market (or wherever you're at) and can help you identify opportunities that maximize your increased buying power.

4. Consider rate locks if you find a home you love. Most lenders offer the ability to lock in your rate for 30-60 days while you complete the purchase process, protecting you from potential rate increases.

5. Explore different loan options with your mortgage professional to find the best fit for your financial situation and goals.

6. Don't overlook the importance of your credit score. Even a small improvement in your credit rating could lead to a better interest rate, compounding the benefits of the market's overall rate decrease.

Looking Ahead: What Experts Predict for Mortgage Rates

While no one has a crystal ball, many housing economists expect mortgage rates to remain relatively stable or continue their modest decline through the end of the year, barring unexpected economic developments. Some forecasts suggest rates could potentially drop below 6% in 2025, though these predictions should be taken with a grain of caution.

The Federal Reserve's future decisions will play a significant role in determining the direction of mortgage rates. While the Fed doesn't directly set mortgage rates, its policies regarding the federal funds rate and bond purchases strongly influence the broader interest rate environment.

The Bottom Line: Your Opportunity is Now

The current dip in mortgage rates represents a significant opportunity for homebuyers who have been waiting on the sidelines. Whether you're a first-time buyer finally seeing homes within your budget or a move-up buyer looking to leverage your increased purchasing power, today's market offers possibilities that weren't available just a few months ago.

Remember that buying a home is both a financial and lifestyle decision. The right time to buy isn't just when rates are at their lowest—it's when you find a home that meets your needs at a price you can comfortably afford.

With rates at an 11-month low and potentially heading lower, that window of opportunity might be opening wider right now. The $22,000 increase in purchasing power we've seen in the past three months is real money that could help you secure a home that better fits your long-term needs and goals.

Whether you choose to save on monthly payments or stretch your budget to afford more home, the current rate environment has created options worth exploring for anyone considering a home purchase.

Posted by Judy Orr on

Leave A Comment