The Savvy Homebuyer's Guide to Slashing Mortgage Costs

The housing market may feel challenging with fluctuating interest rates and competitive buying conditions, but smart borrowers know something that others miss – your personal financial decisions often have a bigger impact on what you'll pay than market conditions do. While you can't control the economy, you absolutely can influence your own mortgage terms.

Let's explore how savvy homebuyers are saving tens of thousands on their mortgages – and how you can too.

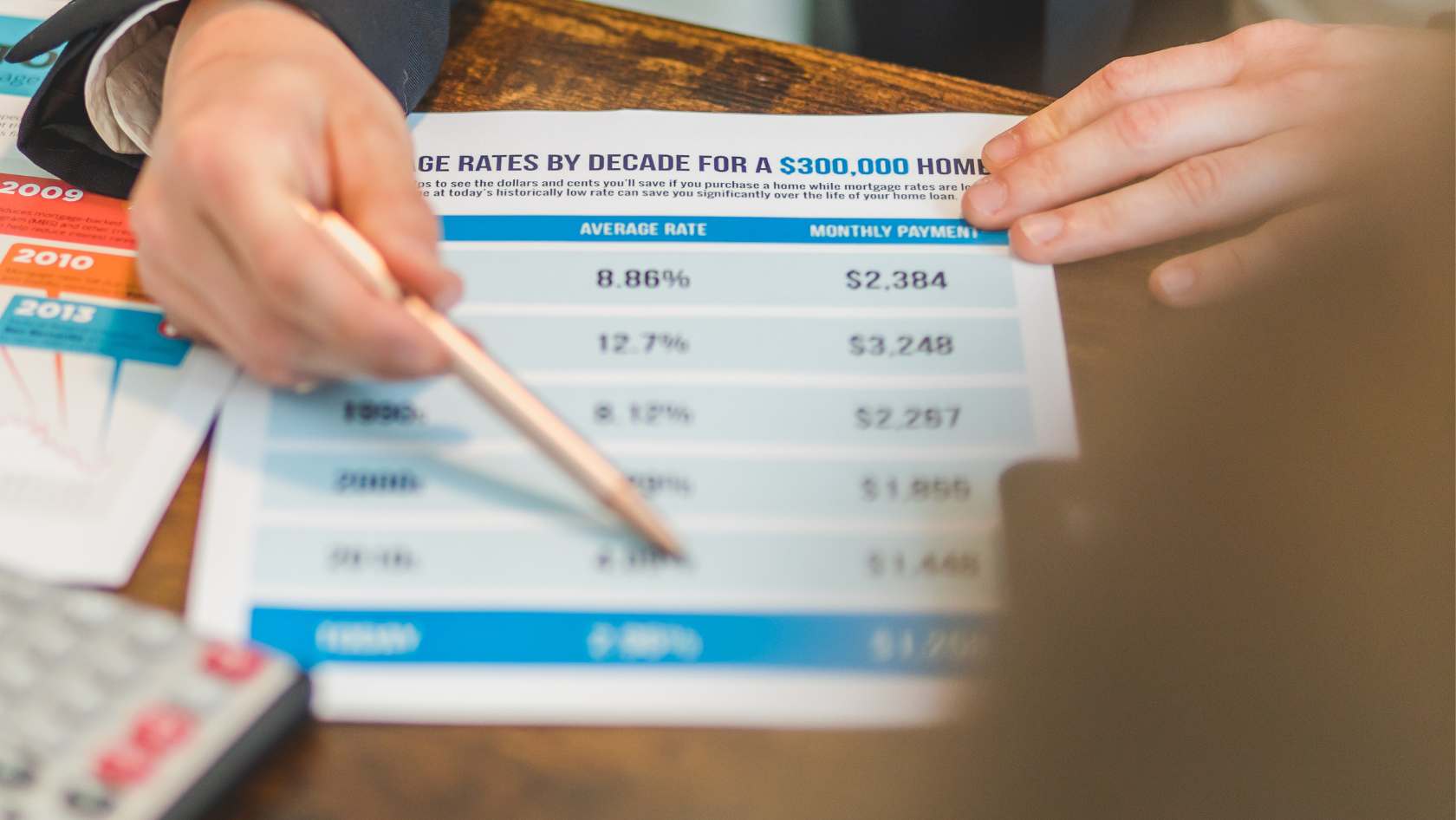

The Surprising Truth About Mortgage Rates

Many homebuyers assume mortgage rates are basically the same everywhere. After all, we hear about "today's mortgage rate" in the news as if there's just one universal number. This common misconception costs borrowers serious money.

At a listing appointment, I had a seller quote me current rates that were lower than what I had just seen from one of my favorite lenders. He was trying to get a point across that rates weren't as bad as everyone was saying, since high rates were being blamed for the slowing market. There was no arguing with him, and I wish I had written this post back then so I could guide him to it. That house is sold and closed, but only after convincing the sellers that their desired price was way too high.

A comprehensive Realtor.com analysis of nearly two million loans revealed something eye-opening: when average rates were around 6.6%, borrowers with stronger financial profiles secured rates closer to 6.25%, while others paid closer to 7%. That might not sound dramatic, but that half-point difference translates to more than $60,000 in additional costs over a 30-year loan on a $425,000 home.

What's even more interesting is that these rate differences weren't just about credit scores or down payments. They often came down to something much simpler: whether the borrower compared multiple lenders or just went with the first option they found.

Why Comparison Shopping Is Your Most Powerful Tool

The single most effective way to reduce mortgage costs is something anyone can do: contact multiple lenders. The same research showed rates varied by as much as 0.55 percentage points between lenders for the same borrower profile.

To put this in perspective, let's look at what that means for a typical homebuyer purchasing a $425,000 home with 20% down:

- Monthly payment savings: approximately $122

- Annual savings: roughly $1,464

- Lifetime savings (30-year loan): nearly $44,000

That's the price of a new car or a significant chunk of college tuition – just for making a few extra phone calls and reviewing some additional paperwork.

Here's how to do it effectively:

1. Contact at least three different types of lenders (banks, credit unions, online lenders, mortgage brokers) on the same day (rates change daily)

2. Request a Loan Estimate from each, which legally must include all costs

3. Look beyond the interest rate to compare the Annual Percentage Rate (APR), which includes most fees

4. Review the closing costs section carefully for origination fees, points, and other charges

5. Ask if they'll match or beat competitors' offers

James, a loan officer with 15 years of experience, explains why this works: "Lenders have different overhead costs, different appetites for certain types of loans, and different profit margin targets. We also have flexibility built into our rate sheets that allows us to compete for business we really want. But many borrowers never ask for a better deal."

Credit Score Benchmarks That Translate to Savings

Your credit score is essentially a financial report card that lenders use to assess risk. While you don't need perfect credit to get a mortgage, even small improvements can yield significant savings.

Let's break down how different credit score ranges typically affect mortgage rates:

- Exceptional (800+): Best available rates

- Very Good (740-799): Nearly the same as exceptional rates (difference of about 0.05%)

- Good (700-739): Slightly higher rates (about 0.11% higher than very good)

- Fair (660-699): Noticeably higher rates (about 0.25% higher than good)

- - Poor (below 660): Substantially higher rates or potential disqualification

Moving from the "good" to "very good" range could save approximately $24 monthly on that $425,000 home with 20% down. That's more than $8,000 over the life of your loan.

Financial advisor Rebecca Martinez recommends these strategies for quick credit improvement: "Pay down credit card balances to below 30% of limits, avoid applying for new credit before mortgage shopping, and check your credit reports for errors – I've seen scores jump 20+ points just from correcting reporting mistakes."

Down Payment Strategies That Pay Off Long-Term

Your down payment affects your mortgage in multiple ways. Beyond the obvious reduction in loan amount, it influences your interest rate and whether you'll need mortgage insurance.

Most conventional loans offer rate improvements at these threshold points:

- 5% down

- 10% down

- 20% down

- 25% down (investment properties)

The biggest jump typically comes at 20%, when private mortgage insurance (PMI) disappears. On our $425,000 example home, moving from 10% to 20% down could mean approximately $281 less per month through combined PMI savings and rate improvement – a staggering $101,000 over 30 years!

If a 20% down payment feels out of reach, don't despair. Consider these alternatives:

- FHA loans require as little as 3.5% down but include mandatory mortgage insurance

- VA loans offer 100% financing for eligible veterans and service members

- USDA loans provide zero-down options for qualifying rural properties

- Many states have first-time homebuyer programs with down payment assistance

- Some employers now offer down payment assistance as an employee benefit

Local housing counselor Maria Chen suggests: "Start by meeting with a HUD-approved housing counselor. They can connect you with local programs most lenders don't even know about. I've helped clients find grants covering up to $20,000 of their down payment through programs they would never have discovered on their own."

How Property Choices Affect Your Rate

.jpg)

Not all homes are created equal in the eyes of mortgage lenders. The type of property you choose directly impacts your interest rate and loan terms.

Properties with the best rates:

- Single-family detached homes

- Planned unit developments (PUDs)

- Townhouses (in many cases)

Properties that typically come with higher rates:

- Condominiums (especially in buildings with low owner occupancy)

- Multi-family properties (2-4 units)

- Manufactured or mobile homes (these do not qualify for a typical mortgage - the loans provided are similar to auto loans)

- Co-ops - in Scottsdale, the co-op units are cash only

- Investment properties (0.5-0.75% higher than primary residences)

- Second homes (about 0.5% higher than primary homes)

Construction quality, property age, and location also factor into lending decisions. Older homes in need of significant repairs may require specialized renovation loans or come with higher rates due to perceived risk.

"Location matters more than many buyers realize," explains real estate appraiser David Wilson. "Homes in areas with declining populations, limited employment opportunities, or high vacancy rates often come with lending restrictions that translate to higher costs for borrowers. It's worth researching neighborhood trends before falling in love with a specific property."

Beyond the Loan: Smart Ways to Reduce Ongoing Costs

Your mortgage is just one part of your total housing cost. To truly optimize your finances as a homeowner, consider these strategies to reduce related expenses:

Insurance Savings:

- Shop your home insurance annually – rates between companies can differ by 30-40%

- Improve home security with monitored systems for potential discounts

- Bundle home and auto policies for typical savings of 10-20%

- Consider higher deductibles if you have adequate emergency savings

- Ask about special discounts for new roofs, impact-resistant windows, or seniors

Property Tax Reduction:

- Review your tax assessment each year and compare it to similar properties

- Appeal your assessment if it seems excessive – about 30% of appeals succeed

- Apply for homestead exemptions and any available exemptions for seniors, veterans, or disabled homeowners

- Document property issues that might justify lower valuations

Energy Efficiency Improvements:

- Start with an energy audit to identify the highest-impact improvements

- Upgrade insulation in attics and walls for immediate savings

- Replace inefficient HVAC systems – modern units use 30-50% less energy

- Install smart thermostats to reduce heating and cooling costs

- Check for utility company rebates and tax incentives before making improvements

Mortgage Optimization:

- Enroll in autopay for potential small rate discounts (0.125-0.25% at some lenders)

- Make biweekly half-payments instead of monthly payments to save on interest

- Refinance when rates drop significantly (typically at least 0.75% lower than the current rate)

- Avoid unnecessary mortgage insurance with strategic loan structuring

Financial planner Thomas Rivera recommends prioritizing these improvements: "Focus first on changes that either eliminate recurring costs or reduce monthly expenses that increase over time. For most homeowners, eliminating PMI, appealing an excessive tax assessment, and improving insulation deliver the fastest payback periods."

Working with Professionals Who Maximize Your Savings

The right team of professionals can dramatically impact your homebuying costs. Here's what to look for:

Real Estate Agent Qualities:

- Extensive knowledge of local market values to prevent overpaying

- Strong negotiation skills backed by data

- Willingness to point out property flaws and potential future expenses

- Connections with reputable inspectors who catch issues before they become expensive surprises

- Experience in requesting and securing seller concessions

Mortgage Professional Traits:

- Transparency about all costs and fees

- Knowledge of specialized loan programs

- Responsiveness during the application process

- Strong reputation with consistent reviews

- Willingness to explain options without pushing the largest possible loan

Kelly, a veteran real estate agent, shares: "I always tell clients that my job isn't to sell them a house – it's to help them avoid buying the wrong house at the wrong price. A good agent should be pointing out problems with properties and identifying negotiation opportunities, not just processing paperwork."

Real-World Success Stories

Michael and Jamie were first-time buyers with good but not great credit. By spending three months improving their credit score from 690 to 735 before applying for loans, they qualified for a rate 0.25% lower than initially quoted. Combined with comparing five different lenders, they saved $167 monthly on their mortgage payment.

Retired couple Robert and Patricia saved over $15,000 in closing costs by negotiating with multiple lenders and having them compete for their business. "We made it clear we were shopping around, and it was amazing how quickly the unnecessary fees disappeared from the loan estimates," Robert explained.

Single parent Alex thought homeownership was out of reach until discovering a local down payment assistance program for workers in education. Combined with a first-time homebuyer tax credit and a lender specializing in teacher home loans, Alex secured financing with just $3,000 out of pocket.

The Angry Buyer

I had a first-time buyer who found a home in Scottsdale that he loved. He was excited and happy. I had given him my favorite lenders, and he called at least one of them. But then he went online.

He saw what he thought was a much better deal with a lower interest rate and filled out his mortgage application. We were getting close to closing when he called me, and he was irate. He was so angry that I thought he was going to cancel the purchase, meaning he would lose the house and most likely his earnest money deposit.

We could have asked for an extension from the seller, but that would have delayed the closing. My buyer wanted to close on the closing date, and this was a while back, when it was more difficult for lenders to get quick approvals and closings. I hope he was able to refinance at a better rate at some point.

Your Action Plan for Maximum Mortgage Savings

Ready to save thousands on your mortgage? Here's your step-by-step plan:

1. Start by checking your credit reports and addressing any errors or issues

2. Save for the largest down payment you can reasonably manage

3. Research specific loan programs for your situation (first-time buyer, veteran, etc.)

4. Contact at least 3 different types of lenders within the same week

5. Compare Loan Estimates side by side, focusing on the APR and total loan costs

6. Negotiate with lenders to match or beat their competitors' offers

7. Choose a property type that qualifies for the best available rates

8. Work with professionals who prioritize your financial well-being

9. Implement post-purchase savings strategies to further reduce housing costs

10. Consider how long you'll stay in the home when making financing choices

The Bottom Line: Your Choices Matter Most

.jpg)

While market conditions certainly influence mortgage rates, your personal choices have an even greater impact on what you'll ultimately pay. By taking control of the factors you can influence – your credit, your down payment, your lender selection, and your property choices – you can potentially save tens of thousands of dollars over the life of your loan.

Remember that mortgage savings compound over time. What seems like a small monthly difference adds up dramatically across decades of homeownership. The effort you put into optimizing your mortgage today will reward you with greater financial flexibility and wealth-building potential for years to come.

The savviest borrowers know that homebuying isn't just about finding a property you love – it's about creating a financial structure that supports your broader life goals. By applying the strategies outlined here, you can join the ranks of smart homeowners who are paying less and building wealth faster through intelligent mortgage decisions.

I have several great lenders I share with my buyers so they can compare. Give me a call at 480-906-1500 and I can send them to you.

Posted by Judy Orr on

Leave A Comment